We could write books about bank guarantees. However, as this is a thematic article and since plenty of books have been written already, we’ll instead focus on some key takeaways for corporates.

MWA THEMES #3 BANK GUARANTEES – the corporate view

MWA Themes are short articles on various topics with a focus on what is most important for you as an exporter or importer. This doesn’t mean that other factors are not important. There are several “product-technical” features to deal with, just as there will specific considerations in relation to the commercial contract.

We could write books about bank guarantees. However, as this is a thematic article and since plenty of books have been written already, we’ll instead focus on some key takeaways for corporates.

Before jumping to the takeaways, let us take a brief look at what a bank guarantee is:

Bank guarantees (aka bonds) are commonly used in international trade where an independent guarantee issued by a bank (or other financial institution) is needed in support of some kind of contract-related obligation. Bid bonds, advance payment bonds and performance bonds are terms you will meet in many cross-border trade transactions.

An independent guarantee is defined as a promise by a guarantor to pay a guaranteed amount to a nominated beneficiary in case the beneficiary present a claim for payment in accordance with the stipulations of the guarantee within the validity of the guarantee.

So – as you see, a guarantee is a very simple and straight-forward instrument.

However, when you scratch the surface you will see that even if the concept is extremely simple, real life soon gets more complicated….

The main reason for this is that applicant and beneficiary will – by nature as well as resulting from underlying contracts – have a lot of opposing preferences leading to disagreements on content and wording of the guarantee.

Another reason is that there is not one single set of rules for guarantees recognized and adopted globally. Likewise, challenges appear in cross-border transactions due to differences in national laws when applicant and beneficiary are domiciled in different countries.

And finally it may be difficult – not least in cross-border transactions – to agree on an acceptable guarantor, e.g. due to poor credit rating or for other reasons.

We are not going to go into a detailed discussion on law and rules etc. in this article – that’s what the books are for. Likewise, for obvious reasons, we cannot go into the details of content and wording of guarantees as this very much depend on the underlying contract.

What we will do is to draw your attention to the two most common sets of rules for international bank guarantees, and to highlight those topics that should always be addressed in a guarantee. Thereafter we will provide some takeaways and recommendations for corporates depending on their role as applicant or beneficiary respectively.

The two most common sets of international rules for guarantees are:

the Uniform Rules for Demand Guarantees (URDG 758), which is issued by the International Chamber of Commerce (ICC) and generally adopted in many countries; and

the International Standby Practices (ISP 98), which is also issued by the ICC and adopted in many countries. ISP 98 is applied mainly in the US and countries with a US-style legal framework. ISP 98 deal with so-called stand-by letters of credit, which in this context is basically the same as a guarantee.

Both sets of rules provide a transparent and fairly objective and logical framework, and with a combined reach that covers most – but indeed not all – countries, it is generally recommended to go for one of these options when and where possible

In guarantees the following topics should always be addressed or at least considered:

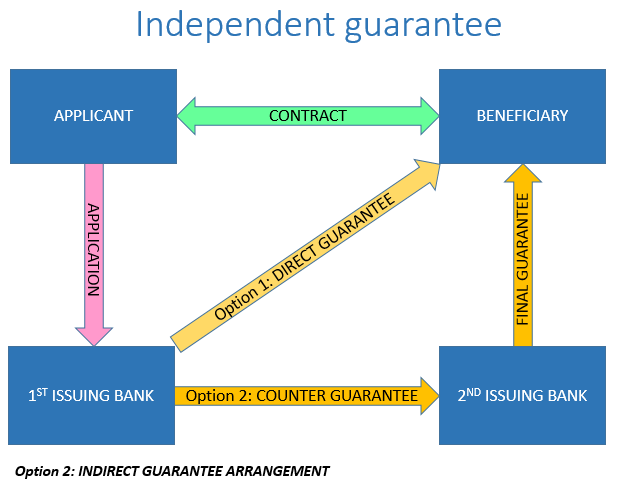

How should the guarantee be issued. Consider if the guarantee should be issued as a direct or an indirect guarantee (see above figure), and also consider if the guarantee should be in paper form, or if it should be issued electronically, e.g. via SWIFT.

What is guaranteed. Surprisingly, you often see guarantees in which it is unclear what is actually guaranteed, and – just as important – what is not. Always give careful consideration to the wording of what is actually guaranteed, and be as clear and accurate as possible.

How and/or when does the guarantee enter into force. If nothing else is stated, a guarantee is normally considered to be in force as soon as it has been issued by the guarantor. However, for example in case of an advance payment guarantee, it would be appropriate (and indeed of importance to the applicant) for the guarantee to enter into force only when the advance payment has been settled.

Reduction clause. Consider if the guarantee should contain a reduction clause, e.g. to allow for reduction of the amount of a performance guarantee pro-rata applicant’s gradual fulfillment of his contractual performance obligations. And consider what kind of documentation should be provided in order for the guarantee to be reduced.

When can claims be lodged under the guarantee. If nothing is stipulated to the contrary, claims can be lodged at any time after the guarantee has been issued. However, for example in case of a performance guarantee, it would be appropriate not to allow for claims to be lodged prior to a date when such performance is expected to be completed according to the underlying contract.

Content of claims. Guarantees in international trade are almost always “on-demand” guarantees, i.e. payable on beneficiary’s first demand (claim). Consider what kind of statement(s) claims should contain, and consider if claims shall be accompanied by any other document(s), e.g. copy of prior notice of default from beneficiary to applicant.

How shall claims be lodged under the guarantee. Guarantors usually have a standard phrasing for how claims should be lodged, e.g. physically, electronically, via third party bank or otherwise. For beneficiary in particular it is important to consider if the requirements for lodging of claims are appropriate and acceptable.

Release and discharge mechanism. Guarantors usually have a standard phrasing for how guarantees should be released and discharged. There can be significant national and regional differences as well as opposite preferences depending on your role vs the guarantee – so be alert and pay attention to this topic.

Recommendations based on your role – applicant vs beneficiary

From an applicant point of view you will have the following preferences:

- Guarantee issued as a direct guarantee by your house bank and governed by the laws of your country. In most cases it will be in your interest that the guarantee is also subject to either URDG 758 or ISP 98

- Be as limiting, accurate and specific as possible in describing what is guaranteed

- Claims must contain specific and detailed reference to the nature of your default, and (where relevant) must be accompanied by i.a. a copy of a prior notice of default giving reasonable time for you to remedy the default, and/or other relevant accompanying documentation

- For advance payment guarantees, retention payment guarantees or similar, the guarantee shall enter into force only when the related payment has been received by you

- Claims cannot be lodged prior to the point in time when the guaranteed performance is supposed to be completed

- Reduction clause (when relevant) under which the amount of the guarantee can be reduced against your submission to the guarantor of certain documentation

- Possibility for the guarantor to reject claims provided that you submit documentation evidencing completion of the guaranteed obligation, e.g. by providing copy of shipping documents to the guarantor

- The guarantee cannot be assigned without your prior approval

From a beneficiary point of view you will have the following preferences:

- Guarantee issued by your house bank directly or under an indirect guarantee arrangement and governed by the laws of your country. In most cases it will be in your interest that the guarantee is also subject to either URDG 758 or ISP 98

- If not possible to have a guarantee from your house bank, then it must be issued by a guarantor acceptable to you, and you must make sure to have the guarantee appropriately verified once

- The less limitation on what is guaranteed, the better

- Claims should be defined as first simple demand stating that applicant is in default with respect to what is guaranteed. No requirement for accompanying documents

- For advance payment guarantees, retention payment guarantees or similar, the guarantee shall enter into force as soon as the related payment has been paid by you

- The less limitation on when claims can be lodged, the better

- Avoid reduction clauses. If not possible to avoid, then make sure that any reduction is subject to your prior approval

- The guarantor shall not be entitled to reject claims due to applicant providing documents of any kind, including, but not limited to, copy of shipping documents

As can be seen you will have different preferences depending on your role being either applicant or beneficiary. This natural conflict is not easily solved, but you will often gain an advantage if you take the initiative and move first.

So – be prepared by having made up your mind in advance in a policy document or otherwise, and have your templates ready for contract drafting or handing out to your counterpart as the starting point for negotiations on these matters.

At MWA Trade Finance we can guide you towards the best possible solution – and we can do the negotiation for you, or support you at the table at your discretion. Reach out and let us take a closer look at things together.